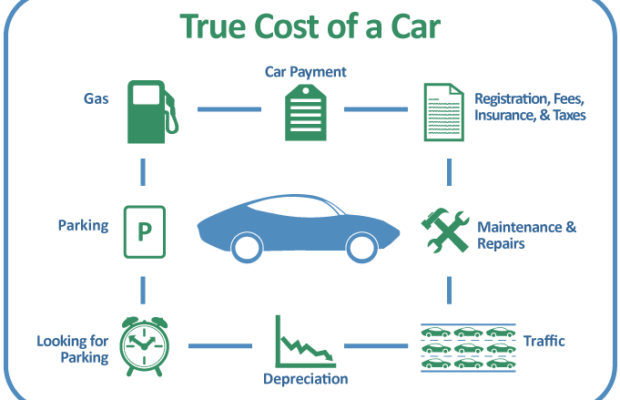

Total cost of car ownership goes far beyond sticker price

Have you ever wondered, “what is the actual cost to own a car?” It isn’t just your monthly payment that makes up the cost to own a car. There are six factors that contribute to the overall monthly cost of owning a car: loan payment, insurance, fuel, maintenance/repair cost, registration, taxes/fees and depreciation. According to AAA, the average cost of new and used cars topped $47,000 and $33,000, respectively in 2022. High demand and low inventory plus inflation played a role in the prices rising steadily.

For an example, say you purchase a used 2019 Toyota Camry for $25,000 and put 20 percent down. Your credit score is sitting at 690, which sets your APR at 5 percent for a loan length of 36 months. The monthly payment figures out to $485. Now if you decide that amount is too high, you can stretch your loan from 36 to 48 months, lowering your payment to $373. It has been found that for every 12 months a loan is extended, the finance charges increase by an average of $1,000, so it is not recommended that you go longer than 48 months on any car loan if you can afford the monthly payment as you will end up paying too much in interest over the length of the loan putting you “upside down” when all is said and done. Your monthly payment typically will represent 50 percent of the true cost of ownership.

The national average for full coverage auto insurance is $1,662 over the course of a year or $138 per month. The younger you are, the higher that amount will be. The amount will also be higher if you have previous claims to your insurance. Since most loan agreements require you to carry full coverage insurance until you have fulfilled the terms of the loan, it is always a good idea to shop around for the best deals and coverage options available.

When you think about the vehicle you want to purchase, fuel cost should be high up on the list of things to consider. In 2022, the average cost of gas nationwide was $3.68 per gallon. If the car you purchase gets 30 mpg and you drive 15,000 miles per year, you will need to budget $1,840 per year or roughly $153 per month for fuel.

Maintenance costs will vary depending on each individual vehicle; it includes regular, routine stuff that every car needs to stay on the road: oil changes, fluid top-offs, tire balancing and rotation, alignments, car washes and filter replacements. Repairs, however, are unplanned expenses that have occurred because something needs to be fixed or has broken on the vehicle. Some examples of repairs include leaking transmissions, failing suspension bad wiring or electrical issues with motors in windows and replacing brakes.

There is also the annual cost associated with registration for the state that you live in. This amount is due every year and is based on where you live and the value of the vehicle you own and the weight of the vehicle. Since we used a 2019 Toyota earlier, we will use that same vehicle to estimate the yearly registration cost. GVWR is 3,340 pounds, multiplied by 40 percent, giving you $13.36. The purchase price of the vehicle was $25,000, multiplied by 1 percent, gives you $250. If you add those two numbers together, that equals $263,36, your yearly registration fee.

Finally, we look at depreciation, a measure of how quickly a vehicle loses value. On average, a vehicle will lose $3,334 per year in value. While depreciation is the single biggest cost of ownership, it isn’t an actual out of pocket expense. It only shows up when you go to sell the car years down the road. The Toyota Camry depreciates very slowly; in five years, it will only lose $11,330 of its value. That means when you go to sell it in five years, for example, you will only have paid $25,000- $11, 330 = $13,670 to own it for the five year period.

If we add up all the numbers, the actual monthly cost to own this vehicle ends up being roughly $910, not including depreciation. It breaks down like this: monthly loan payment $450, fuel $150, maintenance and repairs $150, insurance $138 and registration $21.94.

So, when deciding to buy a vehicle, keep some things in mind. Make a budget so you know what you can afford to spend before going to the dealership. If you can, arrange your financing ahead of time so you stick to your budget. When getting your financing lined up, minimize costs by getting the shortest loan term you can afford. Consider a late model, gently used vehicle. New cars lose about 20 percent of their value the moment they leave the lot, so you can save big if you look for a car that is a year or two old. Your insurance costs will likely be less on a car that is not brand new as well. Look for a car that gets good fuel economy to help save at the fuel pump and do research into which vehicle tends to need less mechanical repairs over the length of ownership. All these things contribute to the actual cost of owning a car.

You must be logged in to post a comment Login